FRB 500 Form URLA PE 2011-2026 free printable template

Show details

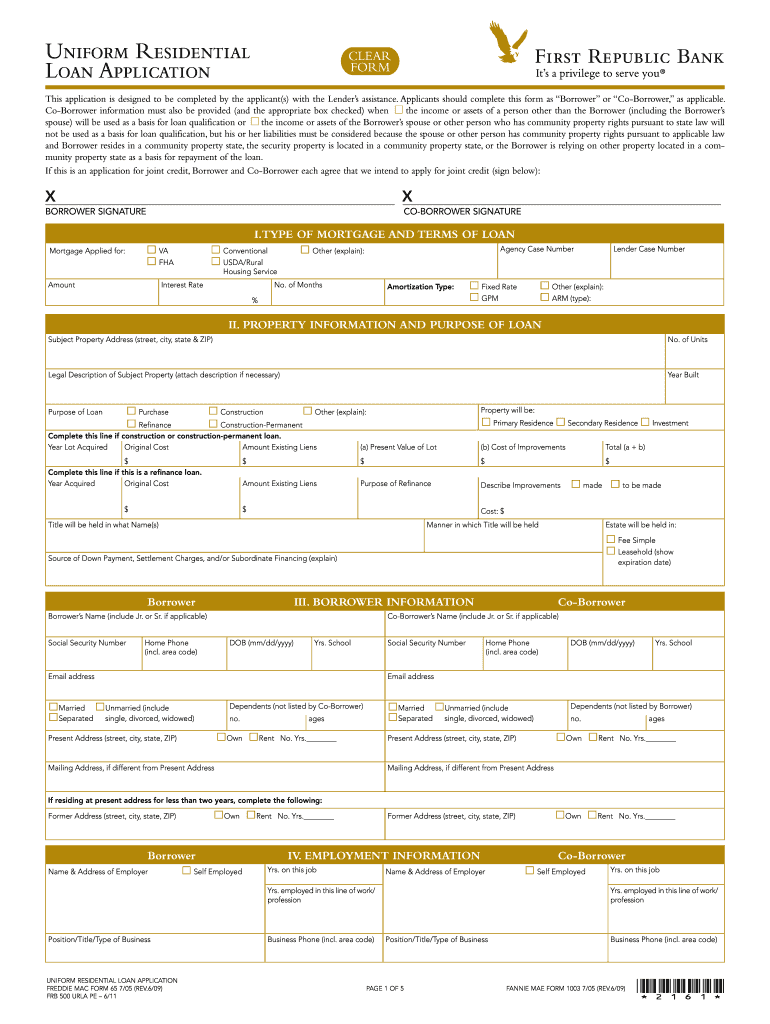

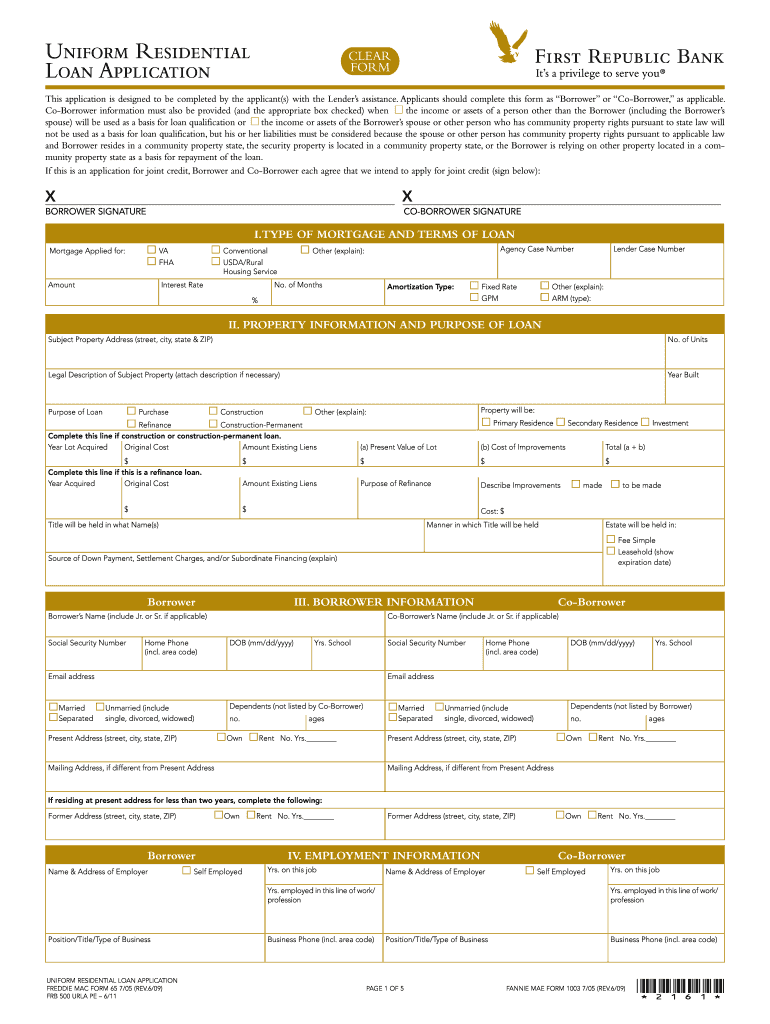

Uniform Residential Loan Application This application is designed to be completed by the applicant s with the Lender s assistance. Mortgage Declaration Addendum Do you have any contingent liabilities not disclosed on the mortgage application or personal financial statement Yes No Do you have any required capital contributions for partnerships or investments If yes please outline the dollar amount and estimate when payable. Are any of your liquid assets pledged Have you ever been convicted or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign blank urla form

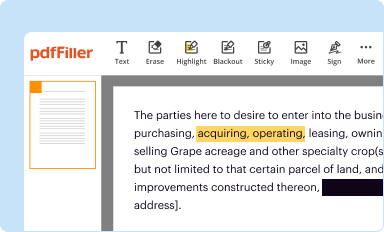

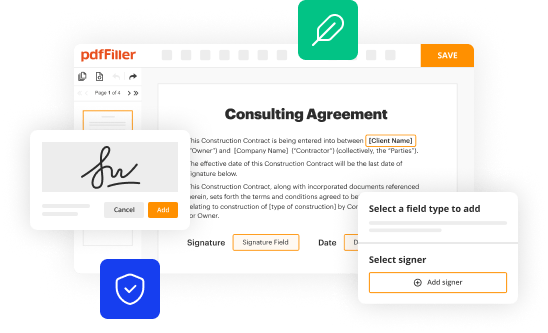

Edit your fillable uniform residential loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

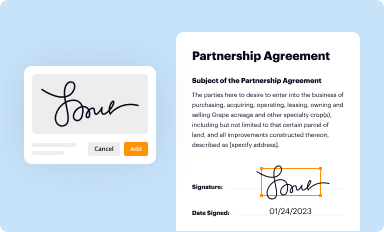

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your urla form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uniform residential loan application online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit urla application form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out urla loan form

How to fill out FRB 500 Form URLA PE

01

Begin by downloading the FRB 500 Form URLA PE from the official website.

02

Fill in the applicant's personal information including name, address, and social security number.

03

Provide details about the loan requested, such as the amount and loan type.

04

Include employment information, including employer's name, position, and income.

05

Disclose any additional income sources if applicable.

06

List your assets and liabilities to give a complete picture of your financial situation.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submission.

Who needs FRB 500 Form URLA PE?

01

Individuals seeking to apply for a mortgage or a home loan.

02

Homebuyers who are looking for financing options through Federal Reserve Bank programs.

03

Real estate professionals assisting clients with loan applications.

Fill

residential loan application form

: Try Risk Free

People Also Ask about urla pdf

What is the final printed version of a loan application?

A Closing Disclosure is a five-page form providing final details about the mortgage loan you've selected.

What completes a loan application?

An application is defined as the submission of six pieces of information: (1) the consumer's name, (2) the consumer's income, (3) the consumer's Social Security number to obtain a credit report (or other unique identifier if the consumer has no Social Security number), (4) the property address, (5) an estimate of the

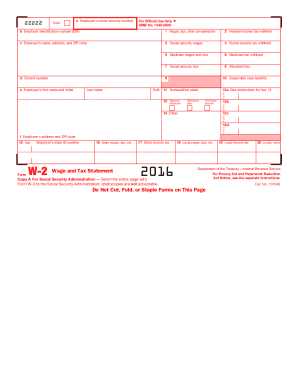

How many pages is a 1003?

Known as the Uniform Residential Loan Application (or the 1003, after its Fannie Mae form number), this five-page document provides a lender with the basic information needed to approve a buyer.

What is the difference between ULAD and iLAD?

The iLAD is a “superset” of loan application data based on MISMO v3. 4 that includes all the data in the ULAD Mapping Document and the GSE AUS Specifications. iLAD also includes additional origination data points requested by the industry that may be needed for exchange of loan information.

What is the definition uniform residential loan application?

Uniform Residential Loan Application is a standardized loan form used in the mortgage industry. This form is called a 1003 form, it requires that borrowers fill out all necessary information before a loan can be established between a lender and the borrower.

What is the loan application form?

Loan Application Form means the application form and any related materials submitted by the Borrower to the Initial Lender in connection with an application for the Loans under Division A, Title IV, Subtitle A of the CARES Act.

What is a loan application form?

A home loan application is a form that is used to get information from a potential borrower to determine if a loan can be approved.

Is a loan application a 1003?

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit urla form pdf in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing urla mortgage and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my urla loan application in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your urla instructions right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit what is urla in mortgage on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign urla 1003 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is FRB 500 Form URLA PE?

The FRB 500 Form URLA PE is a standardized form used for reporting information related to mortgage applications, specifically under the guidelines set by the Federal Reserve Board.

Who is required to file FRB 500 Form URLA PE?

Financial institutions and lenders that offer mortgage loans are required to file the FRB 500 Form URLA PE as part of their compliance with regulatory requirements.

How to fill out FRB 500 Form URLA PE?

Filling out the FRB 500 Form URLA PE involves providing relevant information such as applicant details, loan terms, property information, and financial backgrounds, typically following the structured format provided in the form.

What is the purpose of FRB 500 Form URLA PE?

The purpose of the FRB 500 Form URLA PE is to collect essential data on mortgage applications for monitoring compliance, assessing lending practices, and ensuring fair lending practices in the mortgage industry.

What information must be reported on FRB 500 Form URLA PE?

Information reported on the FRB 500 Form URLA PE includes applicant demographics, loan details, property information, financial assessments, and any other relevant data that supports the mortgage application process.

Fill out your FRB 500 Form URLA PE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Loan Application Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to ulad mortgage

Related to loan application form ui

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.